Contextualizing the Gap: Canada’s Tech Underperformance Relative to the U.S.

The tech industry has emerged as a significant driver of economic growth in the 21st century. While our neighbors down south have managed to establish themselves as a global leader, Canada has struggled to keep up. In this discussion, I will seek to provide context on the situation and analyze the reasons behind Canada’s underperformance.

Before digging in, a few notes:

While this paper will be focused on the technology industry, many of the points covered can also be applied towards both economies as a whole.

Although potential ways forward are discussed as a brainstorming exercise towards the end of the article, the primary objective of this document is less about prescribing solutions and more about explaining the factors that account for the disparities between the two nations.

Given the fundamental differences in attitudes and beliefs between the two countries, I am not suggesting that Canada should, or even could, entirely bridge the tech gap with the US. Instead, a more constructive ambition would be to maximize the strength of our tech industry, all while preserving the core principles that uniquely define and characterize Canada.

Contextualizing the Size of the Gap — A Simple Example

According to the World Population Review as of November 2023, the U.S had a population ~9x larger than Canada. All else equal, shouldn’t Canada’s technology industry be roughly 9x smaller? After all, we both have a democratic system of government, value civil liberties and individual rights, speak the same language and share similar historical ties.

Looking at the data however, Pitchbook as of November 2023 suggests that the number of private unicorns (defined as private companies valued at >$1bn) in the U.S is 28x greater than that of Canada (692 in the U.S vs. 25 in Canada). This gap is even more pronounced when comparing the aggregate valuation of private unicorns with U.S.-based unicorns being valued 35x higher than those in Canada.

Understanding the Reasons Behind Canada’s Underperformance

The disparity in the technology sectors of the U.S. and Canada can be traced back to three fundamental, interconnected reasons. It's important to understand that outcomes like 'brain drain', a less varied economy (with Canada leaning more towards natural resources), and decreased labor productivity are all consequences stemming from the following discussed factors.

1 — Canadians are less capitalistic: To drive home this point, let us observe the differences between the healthcare and education sectors between the two nations. The U.S., with its more pronounced capitalistic ethos has led to largely privatized, market-driven healthcare and education systems. While this model often results in high costs for the end consumer, it drives innovation and excellence as providers strive to outperform competitors. However, this approach also contributes to a more significant wealth gap, as those with more resources can afford better healthcare and education. In contrast, Canada, being less capitalistically oriented, adopts socialized healthcare and heavily subsidized public education. This approach provides more equitable access to these essential services but may arguably limit the competitive drive that often sparks significant innovation. Furthermore, it tends to result in a less pronounced wealth gap, as access to education and healthcare is less dependent on personal wealth. These different approaches in managing healthcare, education, and wealth distribution reflect the broader economic attitudes in each nation, and understanding them is crucial when analyzing the foundational elements driving their respective tech industries.

Neither of these approaches is inherently superior or inferior — each reflects a trade-off according to differing societal values. Both the more individualistic U.S. and the more collectively oriented Canada offer unique perspectives. By understanding these contrasting approaches in managing healthcare, education, and wealth distribution, we can strike a balance that optimizes productivity and economic output while still upholding Canadian values.

2 — Weaker entrepreneurial culture leads to less robust innovation hubs: A significant factor is the cultural climate and the ability to foster innovation hubs. The US has been successful in creating environments like Silicon Valley, which offer intellectual network effects encouraging risk-taking and entrepreneurship. This culture has effectively supported the generation of ideas, access to talent, mentorship, and resilience in the face of failure. On the contrary, Canada, despite making strides in cities like Toronto and Vancouver, hasn’t replicated this to the same extent, resulting in a comparatively less innovation-focused culture.

The exhibit below illustrates that IT professionals in the U.S are concentrated mainly in hubs across the country. Notable hubs include: the San Francisco Bay Area, New York, and Miami.

3. Less investment and funding opportunities: The U.S. boasts a sizeable and dynamic private capital ecosystem (across all company life stages), particularly concentrated around its core hubs. This vibrant environment offers substantial funding, fostering the growth of tech startups. In contrast, the private capital ecosystem in Canada is significantly smaller, which directly influences the availability of investable capital. As highlighted in the previously mentioned points, this discrepancy can constrain the opportunities for Canadian tech startups to secure the funding necessary for expansion

Productivity Potentials: Leveraging Canada’s Economic Advantages

1 — Skilled and Growing Technical Workforce: At its core, the ability to ideate, build and sustain successful companies is a peoples business. It is the output of what results when a group of intelligent, educated, passionate and hardworking people unite their efforts to address an unresolved issue, or to enhance the solution to an existing problem.

According to CBRE’s 2023 report on North American tech talent, since 2020, Canadian tech talent grew by 15.7% outpacing the U.S. growth rate of 11.4% for the same period. In absolute terms, there were 1.1m tech workers in Canada and 5.9m tech workers in the U.S. for 2022 despite Canada having a population that is 9x smaller.

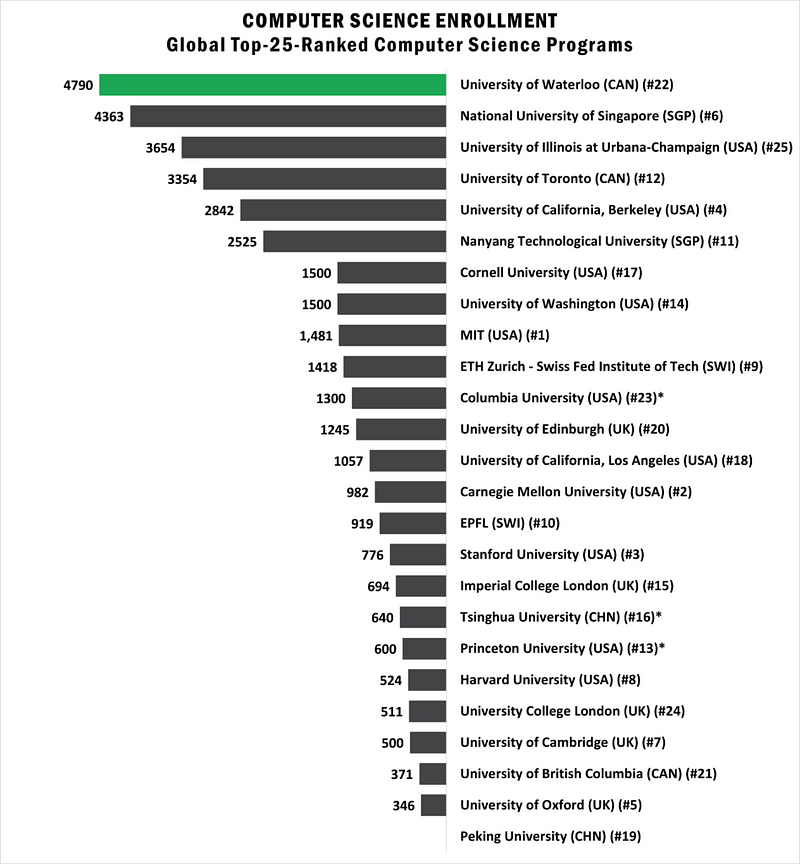

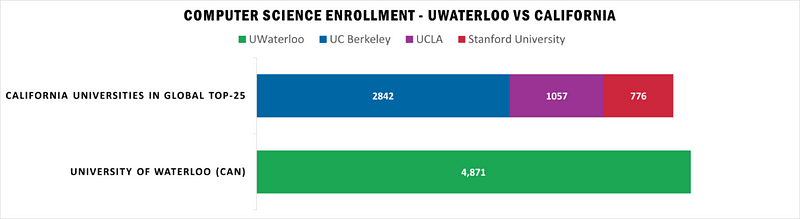

Canada is particularly strong as it relates to producing top engineering and technical talent. Notably, the University of Waterloo, for instance, produces twice as many computer science students as Stanford and MIT combined, according to the Waterloo Region Economic Development Corporation. The University of Toronto also holds an impressive reputation as it relates to computer science enrollment, securing the 4th rank globally, even outpacing prestigious Ivy League institutions such as Harvard and Stanford.

Each year, Canada loses approximately 0.7% of its population to the U.S.., with many of those emigrants being skilled technology workers seeking higher-paying opportunities. A strengthening Canadian tech industry has the potential to reverse this trend. This change could create a positive flywheel effect — a stronger tech industry would mean less brain drain, and less brain drain would further strengthen the tech industry.

2 — The Appeal of Canada as a Satellite Office for U.S. Businesses: Canada’s blend of relatively lower salaries and a highly educated, skilled labor force have emerged as substantial attractions. The increasing trend of U.S. businesses establishing branch offices in major Canadian cities could create a snowball effect, spurring the evolution and expansion of Canadian tech hubs. Leveraging these companies’ expertise and the mounting tech density in our centers could significantly accelerate the pace of nurturing and expanding home-grown Canadian businesses.

3 — Unified Regulatory Power: Canada’s more centralized governance, often referred to as a statist model, holds potential advantages in fostering a tech-friendly environment. Unlike in the U.S., where each state individually crafts its tech regulations, Canada’s nationwide policies allow for a more coherent and unified approach. This centralized model enables swift implementation of tech-friendly policies across the entire country, leading to faster realization of outcomes. This regulatory agility could be strategically harnessed to accelerate the development and competitiveness of Canada’s tech industry on a national scale. Regulatory measures could include, but not be limited to, incentivizing tech startups, promoting digital literacy, fostering tech-focused education, and streamlining procedures for international tech talent immigration.

Potential Ways Forward

Canada could consider the following strategies to tackle the three key issues leading to Canada’s underperformance described prior:

1—Streamlining Procedures for International Tech Talent Immigration: Global talent can substantially contribute to the growth of a country’s tech industry. Therefore, simplifying and accelerating immigration procedures for international tech professionals can enhance the talent pool. Canada could also consider special visa programs aimed at attracting skilled tech workers from around the world.

Efforts under this category are well underway. In June-2023, the government of Canada released a proposal outlining their tech talent strategy:

New innovation exemption under the international mobility program: Expected to launch by the end of 2023, the government of Canada plans to introduce an innovation exemption under the international mobility program that aims to create an easier pathway for foreign employees to work in Canada. Two options are being considered: employer-specific work permits for up to five years and open work permits for up to five years in select in-demand occupations.

Promoting Canada as a destination for digital nomads: over the coming months, Immigration, Refugees and Citizenship Canada (IRCC) will collaborate with public and private partners to determine additional policies to attract digital nomads. The expectation is that digital nomads who initially enter Canada to work remotely will decide to seek opportunities with Canadian employers.

A streamlined work permit for H-1B specialty occupation visa holders in the US to apply to come to Canada: As of July-16-2023, H-1B holders in the US, and their accompanying immediate family members, will be eligible to apply to come to Canada. Approved applicants will receive an open work permit of up to three years

Improvements to the Start-Up Visa Program: The Start-up Visa (SUV) Program provides a path to permanent residence for foreign entrepreneurs who gain the support of a designated Canadian venture capital fund, angel investor organization or business incubator for their start-up. More spots were allocated to the Start-up Visa Program under the 2023–2025 multi-year levels plan, tripling the number of expected permanent residents for 2023 compared to 2022 to 3,500 people.

2—Incentivizing Tech Startups: Canada could leverage fiscal policy to increase tax incentives and grants to tech startups, making the country an appealing destination for entrepreneurs. Although programs aimed at improving outcomes for key industries already exist, there is opportunity to tailor and enhance these initiatives to drive even greater impact. Such incentives could also encourage existing businesses to invest in innovative tech solutions.

3—Retaining In-house Tech Talent: One of the key challenges facing Canada’s tech industry is ‘brain drain’, where Canadian-educated tech professionals leave the country in search of more lucrative opportunities elsewhere, primarily in the U.S. To counter this, it’s critical to create attractive conditions that incentivize these talented individuals to stay. The initiatives to retain high-skilled workers within Canada are two-pronged:

a) Facilitating Competitive Salaries Through Improved Access to Capital: The capability to offer competitive salaries to tech workers is, in part, dependent on access to capital. As such, the government and private sectors could collaborate to establish programs assisting startups in securing private capital. Coupled with mentorship, these initiatives could contribute to building a financial landscape that enables Canadian tech companies to offer salaries commensurate with US standards (adjusted for cost of living). Further, there is snowball effect inherent in compensation whereby as more businesses build in Canada, the increased demand for skilled employees should naturally drive wages upwards.

b) Cultivating a Dynamic Tech Culture: A vibrant, dynamic tech culture can be the natural result of successfully implementing the above measures and fostering robust tech hubs. Unified branding, complemented by innovative slogans promoting the formation and advancement of technology hubs, could serve as a catalyst in accelerating the evolution of Canada’s tech culture. Such strategic branding initiatives could also help foster a national identity that embraces and champions tech innovation. Under such conditions, despite minor pay discrepancies, talent in Canada may be more willing to stay at home.

Each of the aforementioned initiatives can exert a substantial influence when combined and executed concurrently. They are all feasible under our governmental system and can be accomplished while maintaining the core values that define Canada. The synergy of these strategies could facilitate a tech revolution that is uniquely Canadian, balancing progress with our cherished principles.