Go where people are spending their time and attention

As an investor, understanding where people allocate their time and attention has become an important indicator of emerging trends and business opportunities. By analyzing activities that capture public interest, it is possible to anticipate shifts in demand, capitalize on viral phenomena, and mitigate risks associated with declining interests. Monitoring human attention not only reveals the present pulse of the market but also offers a predictive lens for strategic investment decisions.

Gaming’s become a big deal in entertainment. The industry is valued at ~$184BN as of 2023, with mobile games making up half the value. It is expected that there will be 3.8BN gamers worldwide by 2026. Moreover, video games are outpacing other entertainment forms (social, video streaming, music, reading etc.) in both users and growth. Notably, esports have risen to surpass all traditional sports in popularity, with the exception of soccer.

This trend is even more pronounced when observing teenage cohorts. In the US, 85% of kids aged 13–17 play video games, with boys leading the charge at a whopping 97%. More than half of these teens are gaming daily, swapping out traditional entertainment for their consoles and screens. But it’s not just about the games themselves — it’s turned into a social meeting ground. About 90% of teens are playing with others, and half have even made friends online through gaming. For two-thirds of them, hanging out with others is the main appeal.

And it’s not just teens. If you’re under 50 in the US, chances are you’re spending more of your free time gaming than on social media, streaming, TV, music, or reading. With so many people, especially younger cohorts, investing their time and attention in games, all of this points to one thing: the gaming sector warrants a closer look as an investor.

Signs pointing to the industry’s upward trajectory

Tech improvements give games a bigger boost compared to other forms of entertainment: When tech improves — like faster processors, better connectivity, or smarter AI — it doesn’t drastically change how we listen to music, watch movies or interact with others on social media. But for games, it completely ‘levels-up’ the gaming experience through more engaging and complex multiplayer setups that are more enjoyable to play.

Enhanced personalization: Thanks to various tech improvements, games are becoming increasingly personalized. This has in turn created more ways for games to monetize (free-to-play, subscription, buy once, pay per session, and other microtransactions like loot boxes), each optimized for specific games.

Higher monetization rates: Unlike music or streaming services where you pay one fee for everything, given the many ways to monetize described prior, games can make more money per person and per hour played. This means there’s potential for higher take-rates in gaming compared to other entertainment forms, increasing the rate at which firms can deploy capital to tech improvements and personalization creating a flywheel.

Emerging trends

Gen AI: I know, it seems to be a buzz word that is being dropped everywhere but for gaming, there are powerful applications. From personalized game plots, dynamic worlds and custom generated audio, scripts, plots, game assets, game characters, and agents. According to a May 2023 survey by a16z, 80% of studios plan to leverage AI in their next project for design inspiration and storytelling. Smaller teams will likely lead the adoption curve due to resource constraints, while larger studios face higher risks requiring more thorough vetting.

Esports and pro gaming: The rapid growth of esports and professional gaming can be attributed largely to the robust communities that support them. Much like traditional sports, the gaming world thrives on aspirational figures whom players can emulate and admire. This dynamic contributes significantly to the increasing popularity, sophistication, and professionalization of esports, which in turn further expands the appeal of gaming as a whole. Juniper Research expects the number of esports/gaming viewers will reach 1BN by 2025.

In-game advertising: Native in-game advertising enhances user engagement and revenue without disrupting gameplay, as seen with platforms like Unity Ads. This approach effectively monetizes games while building brand awareness. The sector is projected to grow 12.6% annually, potentially reaching $15.9 billion by 2028.

Streaming and content creation: Platforms like Twitch and YouTube Gaming enable gamers to monetize their skills through live streaming and content production. These channels serve dual purposes: entertainment for viewers and effective marketing avenues for businesses targeting either gaming enthusiasts or a particular demographic.

Crypto-enabled play-to-earn: This model integrates blockchain technology to reward players with cryptocurrency for in-game achievements and participation. Tokenization of in-game assets also unlocks interoperability. While it presents novel economic opportunities, the development of a sustainable, large-scale economic model in crypto gaming remains unsolved.

Potential hurdles

Regulatory impacts of mandated limited screen time: China has legally mandated limited screen times for kids/teenagers. South Korea had similar regulations between 2011–2021 (a decade long curfew!). North America currently relies on guidelines (WHO, AAP, etc.) rather than strict regulations, but research on screen time impacts continues to evolve. Strict screen time regulations are unlikely in the West, but new regulations from large nation-states poses a significant risk to the gaming industry.

Regulatory impacts on gambling-like functionality: Loot boxes, which are significant profit drivers for game studios, face partial or full bans in countries like Belgium, Netherlands, Japan, Australia, and Spain, though enforcement has been inconsistent. Counter Strike for instance, generated ~$1BN of profit in 2023 from loot boxes alone (loot boxes have near 100% gross margins!).

Decreasing marketing efficiency on mobile due to IDFA deprecation: IDFA stands for Identifier for Advertisers and are unique identifiers used by Apple on IOS devices to track users. Deprecation is akin to trying to market with a blindfold on. Since advertisers are significantly limited in terms of user tracking, targeting, and attribution capabilities, customer acquisition costs rise. Mobile gaming companies have reacted by developing strategies to encourage user opt-in or utilize alternative data sources.

What is the role of big-tech?

All major tech companies aim to operate at the platform layer. This is likely an area that upstarts will find it very difficult to compete in:

Amazon: Acquired Twitch for $970M in 2014 and operates its own gaming studio, Amazon Games. Also offers Luna, a game streaming service. Provides cloud hosting (and related services) through AWS.

Microsoft: Shifting Xbox from a hardware console business to a software gaming platform business, moving towards an open, interoperable ecosystem. Has historically acquired gaming studios given its distribution capabilities and expertise in scaling infrastructure. Provides cloud hosting (and related services) to the gaming industry through Azure.

Meta: Supports and distributes gaming applications through its AR/VR headsets and its Facebook Gaming application.

Google: Benefits from mobile gaming growth with its 30% take-rate on all purchases made on its app store. Provides ad technology to mobile games. Launched and subsequently shut down Google Stadia (game streaming service), but offers game streaming functionality on YouTube. Provides cloud hosting (and related services) through Google Cloud.

Apple: Focuses on mobile gaming through several strategies: taking a 30% cut on all App Store purchases, investing in native big-budget smartphone and tablet games, promoting the Apple Arcade subscription service, and augmenting gaming experiences via Apple Vision Pro AR/VR headsets. The company recently announced a game porting toolkit to facilitate the development and porting of existing games to Apple devices.

What does the value chain look like and where can we find the investable opportunities?

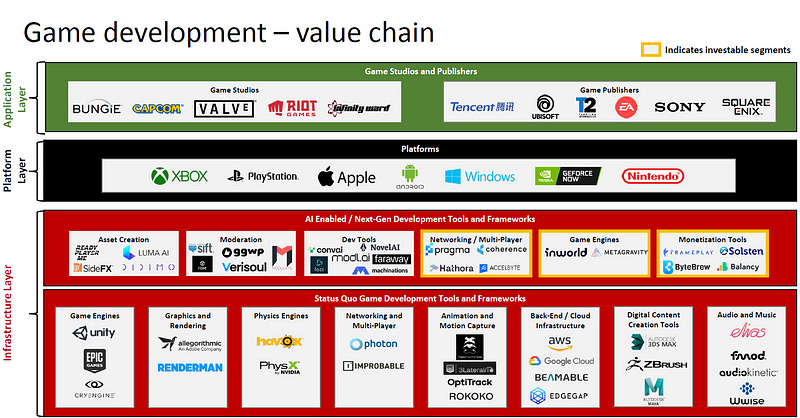

The gaming value chain can be separated into three layers: 1) infrastructure (which can be further bifurcated into 1a) AI enabled / next-gen and 1b) status quo / legacy), 2) platform and 3) application. The core investable universe lies in category 1a which seeks to enhance or displace legacy infrastructure solutions in category 1b. Most gaming studios outsource infrastructure, with 94% doing so partially and 23% fully. Lets take a closer look at each of these layers one-by-one:

Application Layer:

Game Studios: Succeeding as an emerging gaming studio is incredibly difficult due to 1) inability to leverage existing IP and storylines 2) smaller budgets leading to lower-fidelity games compared to AAA studios 3) games often behave as fads with rare long-term popularity. Majority of big tech has acquired gaming studios which failed post acquisition.

Game Publishers: Publishing is and will likely continue to be dominated by large technology or gaming conglomerates who have the resources and distribution capabilities to bring top games created by studios to market.

Platform Layer:

As discussed prior, this layer will likely be entirely dominated by big-tech or large gaming conglomerates

Status Quo Infrastructure Layer:

Many of the logos in this section are owned and operated by large enterprises (e.g., Unity, Epic, Adobe, Nvidia, AutoDesk, Amazon, Google) who are too large/mature for private equity. These established players are potential targets for disruption.

AI Enabled / Next-Gen Infrastructure Layer:

Unlike other segments, this category presents more opportunities for new entrants and innovative startups to disrupt the market. It sidesteps the competition and unpredictability typically linked to new game development and publishing. The segments highlighted in yellow have been chosen for their stickier nature, as they are deeply embedded into game studio operations. Supporting mission-critical functions, these businesses generate more consistent and stable revenue streams. They are preferred over areas like asset creation, moderation, and developer tools, which face higher risks of AI-driven commoditization and/or generate less consistent revenue.

Networking/multiplayer: Provide significant time and cost savings to customers who lack technical capability or large dedicated backend development teams. High switching costs make vendor migrations rare.

Game engines: Provide essential development tools that dramatically reduce time and costs for game creation. Their comprehensive features and steep learning curves result in high switching costs. As games grow more complex, powerful engines become crucial for efficient, cross-platform development.

Monetization tools: It is currently challenging to track and predict engagement/user behavior due to attribution and tracking limitations. Analytics and monetization vendors focused on the gaming industry have the capability to increase revenues and value per customer.

Note: categories are not mutually exclusive with some overlap between categories

Putting it all together

To recap, below are the key takeaways that consolidates the discussion

Large-scale game developers often internalize various backend functions for greater control and cost management. Upstart gaming infrastructure businesses must thus provide a value proposition that is difficult to replicate in-house.

Gen-AI’s impact, adoption and product-market-fit on game production is still unclear, with a 2–5 year lag between game development and launch.

Mission critical backend-related infrastructure services appear stickier and more differentiated than art/asset-creation tools and language focused moderation tools that are more likely to be commoditized by gen-ai.

Larger game development studios often prefer comprehensive solutions such as the Unreal Engine provided by Epic Games or their own internally developed proprietary software. In contrast, SMB-sized studios typically benefit from using specialized tools designed for specific tasks in the game development process. These tools help smaller studios overcome resource constraints, offer flexibility in project-specific solutions, bridge expertise gaps and enable rapid iteration.

The serviceable market size for infrastructure vendors targeting SMB-sized game studios is unclear and unstable.

The platform layer will likely be dominated by big tech companies.

Unity and Epic Games' Unreal Engine are the dominant industry incumbents that newer infrastructure gaming companies aim to challenge. As of 2023, Unity's technology powers 71 of the top 100 mobile games.

Emerging gaming studios face significant challenges due to limited IP, smaller budgets, and the fickle nature of game popularity

This was very thoughtful!

How do you see the role of user generated content shaping the industry in the years to come?